Can I sell my franchise to someone else? Yes, you can sell a franchise to someone else, but the process […]

Can a Failing Franchise Resale Become Profitable?

One of the most pressing questions of a buyer considering the purchase of a re-sale is, “Can I turn the failing franchise unit into a profitable venture?” The answer will depend on a number of case-specific factors, but usually a franchise with a good brand is unsuccessful because of the franchisee’s failures, rather than the brand or location.

This is supported by many sources of market research. For example, the Small Business Administration provides data showing that less than ten percent of all franchise units in the U.S. fail each year, compared to forty-five percent of independent small businesses. This hints that a failing franchise re-sale is likely an excellent opportunity for an energetic entrepreneur to turn a re-sale into a success story.

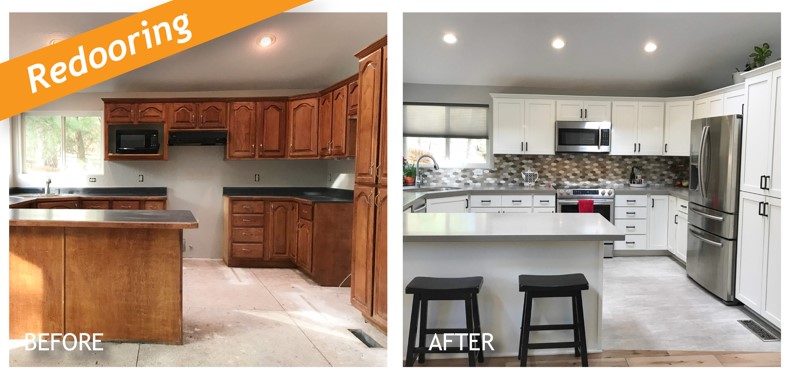

Unlike independent businesses, franchises allow the investor to go into business for himself or herself, but without “going it alone.” Particularly for a resale, the franchise is already up and running. The basic infrastructure is in place, with established vendors, employees, cash flow, and customers, with no start-up period.

However, this does not automatically mean a failing franchise can be turned around. The first order of business is to consult both a professional lease attorney, a local real estate broker, and to ask questions of other franchisees in the area. If other franchisees are turning a profit in the same brand, this might indicate bad management and an opportunity for a successful turn-around.

But there are some considerations to evaluate before presuming the failure has been caused by the seller franchisee. For instance, does the franchise location have a pool of customers living or working within an acceptable distance? How close or far away are other franchisees of the same brand? Are they eating away the sales revenues that would otherwise be available for a turnaround? Are franchisor or lease demands a cause for failure? What upgrades to signs or building designs are required? How costly?

These are the types of questions a prospective franchisee of a re-sale must ask to learn whether or not the failed franchise was caused by factors outside of direct management. Due diligence is an indispensable aspect of making any investment, including re-sales. Part of this due diligence will also involve research on the seller’s prior cash flow and marketing choices.

One of the primary causes of any business failure is inadequate cash flow. Did the seller utilize or have available financing? Was the seller plagued with low revenue volume or going through a price war with local competitors? Did he or she fail to institute proper cost management techniques, such as inventory controls? Was the cash flow suppressed by a failure to manage accounts receivable (payments owed by customers, if any)? Has the franchisee seller relied too heavily on one major client for revenues? Was he or she following the franchisor's proven system?

To answer these questions, a potential buyer might need to seek the advice of a mentor or business consultant. Other aids include mathematical software tools that help evaluate demographics and regional consumer traffic. There are also simple formulas, like inventory-turnover, accounts-receivable turnover, and fixed-asset turnover ratios that can help a potential buyer measure the seller’s prior management skills, or lack thereof:

- Inventory Turnover Ratio (ITR) = Cost of Goods Sold/Average Inventory

- Accounts Receivable Turnover Ratio (ARTR) = Total Credit Sales/Total Outstanding Accounts Due

- Fixed Asset Turnover Ratio (FATR) = Sales/ (Net) Fixed Assets

Before these tools can be helpful, the prospective buyer must first review the Franchise Disclosure Document (FDD) and ask the seller for data that’s not otherwise found in the FDD. These include how much revenue has flowed through the business in the past year, total annual fixed costs, and the average time inventories are stored. All three of the formulas are basic division problems. Once the buyer has obtained the necessary raw data and performed the division to provide quotients (ratios), then the buyer should compare those to benchmark ratios. Benchmarks can be obtained from experienced accountants or consultants in the same industry or might be provided by the franchisor. The key to these formulas is that the higher they are in comparison to the industry average, the better. If they are high, this might indicate that the seller’s failure was caused by other factors like location that are not easily fixed by a transfer to a new buyer. However, low ratios are an indication of poor cash flow management and might provide a lucrative opportunity for a turn-around success to profitability.

Before these tools can be helpful, the prospective buyer must first review the Franchise Disclosure Document (FDD) and ask the seller for data that’s not otherwise found in the FDD. These include how much revenue has flowed through the business in the past year, total annual fixed costs, and the average time inventories are stored. All three of the formulas are basic division problems. Once the buyer has obtained the necessary raw data and performed the division to provide quotients (ratios), then the buyer should compare those to benchmark ratios. Benchmarks can be obtained from experienced accountants or consultants in the same industry or might be provided by the franchisor. The key to these formulas is that the higher they are in comparison to the industry average, the better. If they are high, this might indicate that the seller’s failure was caused by other factors like location that are not easily fixed by a transfer to a new buyer. However, low ratios are an indication of poor cash flow management and might provide a lucrative opportunity for a turn-around success to profitability.

Either way, if a prospective buyer asks the types of questions presented above, does due diligence, and seeks the advice of other industry pros, the answers will likely guide the entrepreneur on how to proceed. Failing re-sales can offer a golden opportunity or a gloomy nightmare; it’s up to the buyer to get the answers for an informed decision.

Recent Articles

Why a Salad Franchise is a Fruitful Financial Opportunity

Are salad franchises profitable? Salad franchises can be profitable, but success depends on various factors including location, competition, quality of […]

Home-based Franchise: 12 Options You Can Run Remotely

Can you run a franchise from home? Yes, it is possible to run a home-based franchise, depending on the nature […]

Turnkey Business for Sale: What to Know Before You Buy

Are turnkey businesses profitable? The profitability of turnkey businesses can vary depending on various factors such as the industry, market […]

In Business for Yourself.. and Totally by Yourself !

The much used statement, which screams the benefit of buying a franchise: “In Business For Yourself BUT Not By Yourself,” […]

7-Eleven Franchise: What to Know About Owning a Convenience Store

Owning a 7-Eleven franchise involves a unique business model that is somewhat different from other franchising opportunities. Here's an overview […]